Only one thing matters to us at WiseTraders ... YOUR SUCCESS

How do we make you a better trader?

Education

We educate you in a way you won't find anywhere else.

Tools

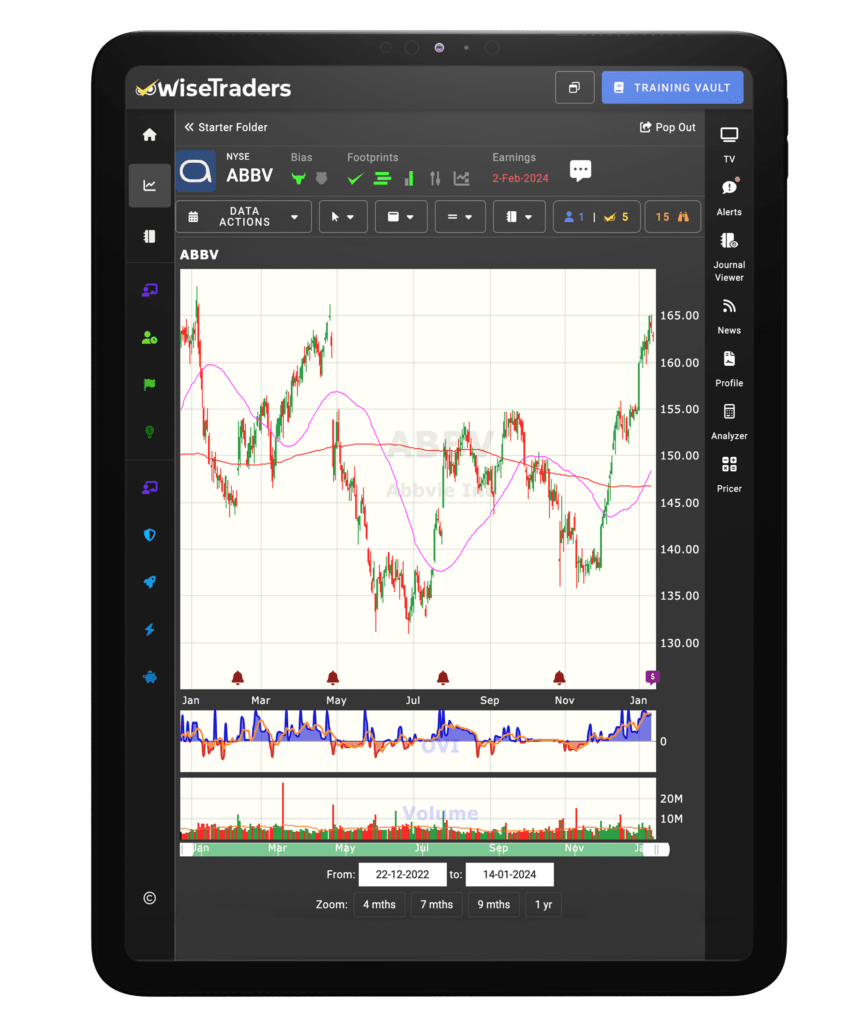

We provide the optimal tools for our strategy.

Support

We support you throughout your journey with us.

Stop following the crowd – they’re nearly always wrong!

Decades of market experience

Proper quant research

A world-class strategy

User-friendly tools

Our unique approach empowers you to trade confidently, responsibly, and enjoyably.

We recognize the demands of busy modern life, whether you’re still working or retired.

Learning new skills can be daunting … but with WiseTraders you’ll immediately notice the care and quality that make learning with us a breeze.

Our focused, dynamic and engaging courseware is arranged in bite-sized modules, which you can easily complete around your own schedule.

Once you’ve learned our game-changing Trade Plan, that’s yours to keep! And then you can choose to apply it optimally inside our user-friendly platform.

Whether you're retired or hold a full-time job, chances are you have a busy life.

Our trading system and patented applications empower you to invest in the Stock Market by finding higher-probability setups in optimal market conditions that no-one else can spot ... all with just one click.

So, you can invest in stocks and options with real professional insight.

No staring at screens. No complex analysis. Our apps do the hard work for you.

Our trading method focuses on three 'Master Keys'

Stock Selection

Follow the "Big Money Footprints" of professional money to find stocks with higher probabilities to perform best.

Trading Plan

Follow our simple EDGE trading plan to manage risk and put YOU in control of every trade.

A Familiar Story?

At WiseTaders we know that simplicity and clarity is essential. With our patented OVI (Options Volatility Indicator) we put you in control and help you place wise trades.

Our Unique suite of tools and training

Learn our way to trade stocks and options using our US-patented applications

- Stocks

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

- Options

Discover the power of trading with responsible leverage through our options courses and applications.

- Mentorships

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

- Events

Supercharge your stocks or options trading journey at one of our live events.

Technology trusted by professionals, designed for you.

- Our stocks and options solutions make trading easier for you by using our innovative tools and training.

- All our products are powered by our proprietary, patented indicator, the OVI.

- Also providing the alpha for professional systems, the OVI is derived from options data and is designed to follow the big money players in the market.

- Guy Cohen's methodology and a dedicated support team will help you with our unique trading approach.

Results may not be typical and may vary from person to person.

1

Choose a solution

Stocks or options? Choose a trading solution that’s right for you.

2

Enrol

Buy your subscription or event – no software installation required.

3

Access

Login to your member’s account to access tools and training material.

4

Trade Smarter

Follow a proven trading strategy to find higher-probability setups and control risk.

Tired of Chasing The Next Big Thing?

Properly researched information has never been more important

With so much misinformation being pushed by so-called 'influencers',

it is harder than ever for traders to find authentic trading methods.

Transform your investing strategy now with our trading edge that stays with you.

Our patented OVI is the source of the unique edge we bring to our members.

- Stocks

We offer a unique solution for traders looking to trade stocks with an edge.

When you trade with the OVI you don't need to be an expert on the market. Focus on a few repeatable setups and master them.

Stocks Essentials

For beginners and above. Stocks Essentials is designed to make stock selection quick and easy combining our automated filtering tools, dynamic training, and 4-step EDGE trade plan.

Stocks VIP

For everyone. This is our ultimate Stocks Membership which equips you with our latest stocks software and training to help you automate each and every one of the Master Keys: Market Timing, Stocks Selection and Trade Plan.

- Options

OptionEasy is the home of all your options applications and education.

Combine OptionEasy strategies with the unique OVI to use options responsibly for leverage, income and risk control.

Options Essentials

For beginners and beyond. Uncover OVI stocks with the optimum balance of leverage, liquidity and risk in just a few seconds with the help of our automated filtering software.

Options VIP

For everyone. Options VIP is our ultimate Options Membership and is designed to automate ALL the hard, boring and emotional aspects of Options trading.

- Mentorships

One-to-one stocks or options coaching with a professional trading mentor.

Transform your trading approach with a personalized, high-impact program that focuses on your goals.

Stocks Mentorship

Tailored to your stocks trading goals, includes access to a range of educational resources and session recordings.

Options Mentorship

Tailored to your options trading goals, includes access to a range of educational resources and session recordings.

- Events

Our live events bridge the gap between theory and applied trading.

Whether you’re a beginner or a trading veteran, you can fast-track your trading journey at one of our events

WiseTraders Stocks Summit

Exclusive for our Stocks VIP members. Guy Cohen will coach you on four OVI strategies that you can start using immediately. You can also attend remotely.

OptionEasy Bootcamp

Exclusive for our Options VIP members. Guy will teach you how to trade his favorite 12 options strategies, plus many bonuses. You can also attend remotely.